It’s no conspiracy. The music will soon stop and the economy will take a big hit when the bubble bursts – even the timing has been chosen.

The Fed has been pumping easy money and buying time with future pain for years now, but the worm is turning. Only, the turn is taking a pause so as to avoid helping – yes – Donald Trump and his bid for the presidency.

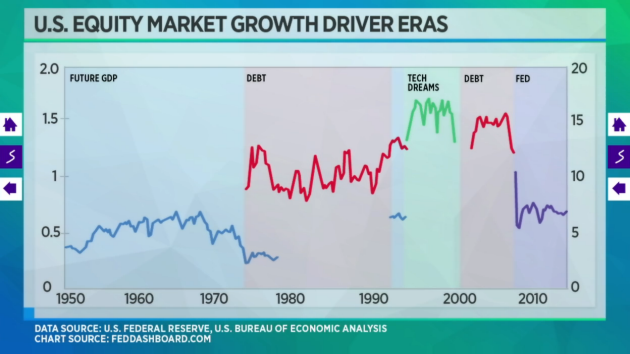

SHTF just reported on the startling revelation that not only has quantative easing changed the financial landscape in the wake of the 2008 financial crisis, but it has been directly responsible for a full 93% of market action since that time.

The Federal Reserve is a leviathan if there ever was one. Even its whispers float boats and sink ships. Easy credit has gone so far beyond the logical extremes, and the proverbial roadrunner has pointed out that we are all hanging out over a cliff.

Contracting the money supply (by raising interest rates) is the snap reaction, but it will hurt. So they are prolonging the pain in order to shift the blame and distract everyone from the real problem as much as possible.

Like everything else, it is now somehow Donald Trump’s fault. This time, because the Fed is a in a position where it supposedly “can’t” raise markets and stabilize the economy.

Via the New York Post:

Like it or not, the Federal Reserve will play a big role in this year’s presidential election.

The Fed last week pulled back on its economic outlook for 2016 and beyond. […]

The upcoming election and, especially, the surprising strength of Donald Trump also make it almost impossible for the Fed to boost rates. If Trump gets elected, the Fed will almost immediately be hit by audits that will reveal lots of secret, sinister things.

So Fed Chair Janet Yellen and her fellow central bankers can’t do anything — like raise the cost of money — that might slow the economy down and give Trump a better shot at winning the presidency.

[…]

But then the Fed gets boxed in by politics, especially because of Trump. Even though it eased policy in a controversial move right before the re-election of President Obama, the Fed will probably use the November election as an excuse to freeze policy until after the vote. It doesn’t want the economy to weaken or, worse, the stock market to tank.

Wow.

Sounds like the Fed, which so often claims not to be political, is admitting to the political weight of its station – which is, incidentally, private and quite powerful indeed over American life. The “politics” are over calls to make it accountable, a task which is apparently insurmountable and somehow detrimental to economic stability, itself a fragile ghost.

The Federal Reserve’s power over monetary policy and the power it derives from issuing currency to the nation at interest are at the heart of why former Congressman and presidential candidate Ron Paul has called for auditing and ultimately ending the Fed:

Allowing a secretive central bank to control monetary policy has resulting in an ever-expanding government, growing income inequality, a series of ever-worsening economic crises, and a steady erosion of the dollar’s purchasing power. Unless this system is changed, America, and the world, will soon experience a major economic crisis. It is time to finally audit, then end, the Fed.

Donald Trump, who has proven to be a lightning rod on all issues, has pointed out that Janet Yellen is likely holding off on raising rate because it is clear from basic policy dynamics that the massive recession that has built up like a puss-filled sore would burst, and in turn, Obama’s Administration would appear culpable for the decline.

Instead, Trump has charged, the Fed is putting that off in order to avoid giving his candidacy a boost – nevertheless, the recession is probably inevitable, and a clear result of Federal Reserve monetary policy.

Yellen is “keeping the economy going, barely,” Trump told The Hill. “The reason they’re keeping the interest rate down is Obama doesn’t want to have a recession-slash-depression during his administration.”

He added: “Janet Yellen is highly political and she’s not raising rates for a very specific reason: because Obama told her not to because he wants to be out playing golf in a year from now and he wants to be doing other things and he doesn’t want to see a big bubble burst during his administration.”

They’ve got everyone at gun point, but the gun is concealed, and they won’t let anyone looking in their pockets or question their moves.

‘Don’t anybody get political around here, or the economy gets it…’

The problem with gun control is that criminals don’t follow the laws, and the rest of the economy is totally disarmed and unable to do anything about the hostile actions of the nation’s central bank, save the few who have a bit of gold or silver to turn to. This is economic autocracy in action.

Read More:

Trump Accuses Fed of Not Raising Rates Because Obama “Doesn’t Want a Bubble Burst” Until He Leaves

Ron Paul: Unless the Fed is Stopped, America Will “Soon Experience Major Economic Crisis”

“Fed Risks Triggering Panic and Turmoil”: World Bank Warns Against Raising Rates

Proof It Is Rigged: “Fed Moved 93% of Entire Stock Market Since 2008″