Last month All News Pipeline warned that major banks were preparing to tighten the screws on American account holders starting April 1st.

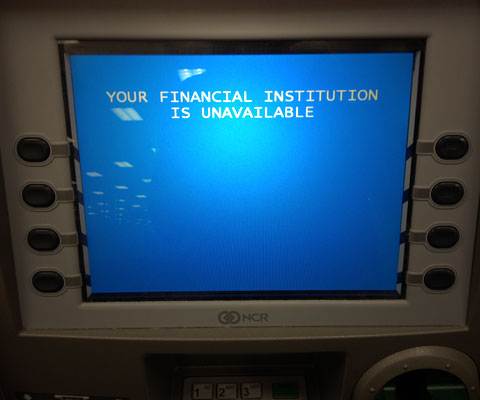

It appears that the lock-down of cash has begun.

Citing criminal activity as a factor, JP Morgan is limiting cash withdrawals at ATM machines.

The bank said there doesn’t appear to be fraud involved. But partly due to heightened regulatory scrutiny, banks are paying more attention to large cash transfers that could be a sign of money laundering or other types of shady activity. Typically, the card-issuing bank sets withdrawal limits, not the bank owning the ATM.

The move by the largest bank in the U.S. doesn’t affect J.P. Morgan Chase’s own customers, whose maximum daily withdrawals are set depending on the client’s account type. The bank has seen high-dollar withdrawals at both new and old ATMs, said bank spokeswoman Patricia Wexler.

J.P. Morgan Chase’s change last month affects roughly 18,000 automated teller machines nationwide and followed an interim step earlier this year limiting noncustomer cash removals at $1,000 per transaction. The earlier move was made as a temporary fix while the bank could make software changes to roll out the more stringent daily limit, Ms. Wexler said.

She added that the bank “felt it was prudent to set withdrawal limits on all of our ATMs” after identifying some large cash withdrawals from noncustomers.

In 2015 we warned readers to divest some of their assets out of bank accounts for this very reason, noting that bank glitches and arbitrary holds would begin to affect more and more depositors. And while the recent move by JP Morgan Chase appears to only affect non-customers, a recent report indicates that the Justice Department has advised bank tellers nationwide to keep any eye out on cash transactions. Suspicious activity, which by the government’s definition is as little as $3000, should be reported to law enforcement and under existing guidelines police can then seize those funds without charge or trial:

“[W]e encourage those institutions to consider whether to take more action: specifically, to alert law enforcement authorities about the problem, who may be able to seize the funds, initiate an investigation, or take other proactive steps.”

After the massive bailouts required to save the system following the crash of 2008 bank and regulators worked together to ensure that all deposit accounts in the United States are no longer the property of depositors, but rather, the banks themselves.

all customer funds in the United States are now the legal property of JP Morgan, Goldman Sachs, BNYM, or whichever megabank is the counterparty on the loans the FCM or depository institution takes out in order to fund its mega-levered proprietary in-house trading desks.

In a recent interview intelligence insider Jim Rickards discusses this recent trend and provides insights into how susceptible the banking system is to not just cyber warfare or power grid failure, but confiscation in the form of bank bail-ins or outright government seizure.

Also Read:

How to Hide Your Money Where the Bankers Won’t Find It

What Guns? What Gold? Prepper Tips On “Hiding Your Guns in Plain Sight”