It could all be over tomorrow. A truly modern threat.

The threat of an EMP – via natural event or deliberate attack – remains a grave one. Its potential as a WMD looms larger than any other weapons known to man.

Due to the dependency of modern society on electricity, supply chains and cities, an electromagnetic pulse wave poses a threat that really could kill or cripple 90% of the population.

It is a system wide reset that few are prepared for.

As WND reported:

Think this couldn’t happen in today’s America?

Think again, says former Defense Department security policy analyst and WND national security writer Michael Maloof. All it would take is an EMP attack to knock out all “life-sustaining critical infrastructure.”

[…]

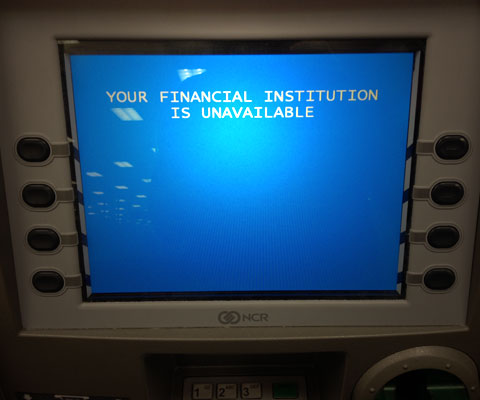

“And if the electrical grid system is knocked out, it affects everything that depends upon that electrical grid. It could include our telecommunications, our banking and finance systems, our petroleum and natural gas transportation systems, our food and water delivery systems, our emergency services. It also affects all of the automated control devices that we take for granted every day, like the automatic control of lights, our surge system.”

He added, “It would be a nightmare you’ll never wake up from.”

The impact on life supporting-medical devices alone would be devastating to millions of people in the population.

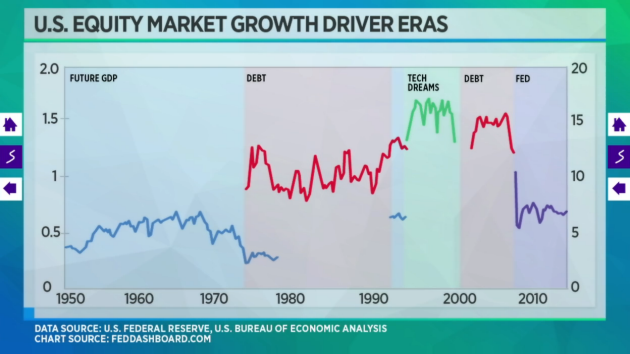

It is a stark reminder that all the high technology of this world has been built on a fragile and very vulnerable foundation.

Such an event would also render hospitals unable to help their patients, as they rely on electronics. People with pacemakers or other electrical-based medical devices would suddenly lose their source of life.

“One thing people don’t really talk about is the impact it would have on nuclear reactors,” added Maloof, who wrote about the EMP threat in his book “A Nation Forsaken.” “When you look at what happened in Fukushima in Japan a few years ago with just one reactor, the impact on something like 147 nuclear reactors we have in the United States could be not only catastrophic, but cataclysmic.”

As SHTF has reported numerous times before, these effects could be minimalized if the government worked with the private sector to reinforce the grid, and protect critical infrastructure.

The problem is that this is very expensive, the grid is very old, and the powers-thatbe are much more likely to capitalize on the fear and horror after an event has already taken place… rather than simply resolve the issue with proper shielding.

Of course, that may change. But will it be too late?

The military has moved many of its vital operations, equipment and contingency forces back to Cheyenne Mountain to reinforce the continuity of their operations; numerous government agencies have taken similar measures.

But the vast majority of the population remain dangerously unprotected. Self-reliant individuals can, however, prepare for life off the grid, and even protect backup electronics in a homemade Faraday cage, as SHTF previously reported:

“Island yourself” from the central grid… that’s former FERC chief John Wellinghoff’s advice to individuals – preppers if you will – for surviving any grid downs that could occur from an EMP, a cyber attack or other event powerful enough to interrupt the highly vulnerable primary grid.

People are beginning to understand that they need their own onsite capabilities to island themselves from the grid. That’s because the grid’s external vulnerabilities will continue to be a problem until we do have substantial amounts of distributed generation. I have a solar photovoltaic system that provides 100% of my power needs. I am looking into how I can island myself off the grid. But it is not just me, the military is moving toward micro-grids at all of their bases because they understand the vulnerability of those bases to outages.

Let us pray that the day never comes…

Read More:

Military Readies Mountain Fortress to “Shield Against EMP Attack”

Congressman Urges Protection for Power Grid: EMP Attack “Could Bring Our Civilization to a Cold, Dark Halt”

“Super EMP” Capable of Disabling Power Grid Across Lower 48 States

EMP Threat: ‘Within One Year 9 Out of 10 Americans Would Be Dead’

What Are You Going To Do When A Massive EMP Blast Fries The U.S. Electrical Grid?